Home » Property Trends » Locality Trends »

As Mumbai is one of the most expensive property markets in the world, buyers must factor in all the allied costs before moving ahead with a property purchase plan. Among these costs, stamp duty and registration charges in Mumbai add significantly to the home purchase amount. In this guide, buyers will know the money to be paid during property registration as the stamp duty and registration charges in Mumbai in 2025 for property registration. Also, know about the rebate announced for woman homebuyers in Mumbai.

Table of Contents

Stamp duty is a tax imposed by states in India on various property transactions. It is mandatory to pay this tax under Section 3 of the Indian Stamp Act, 1899. Stamp duty varies from state to state and is imposed at the time of the registration of legal instruments such as sale deed, gift deed, exchange deed, partition deed, lease deed, relinquishment deed, etc.

Buyers are also expected to pay a registration fee for the documentation work. Typically lower than the stamp duty, registration charges in Mumbai is around 1% of the property value if the property cost is more than Rs 30 lakh. If the value is less than Rs 30 lakh, the registration charges in Mumbai is Rs 30,000.

Started in April 1, 2022, the Maharashtra government levies a 1% metro cess along with stamp duty on property purchase in Mumbai, Pune, Thane and Nagpur. The purpose of this new fee is to gather funds for the development of transportation infrastructure projects. As a result of this metro cess, stamp duty and registration charges in Mumbai have increased to 7%. In Pune and Nagpur, the stamp duty has gone up from 7% due to the introduction of the metro cess.

The stamp duty between developer and housing society will be charged as per conveyance deed.

5% of value of project for women

In Mumbai, women are given a rebate of 1% in stamp duty charges. This is allowed only for residential real estate. Also, this rebate is not valid for joint registration.

Also, know that the Maharashtra government has removed the 15-year cap imposed on women home buyers in return for availing 1% rebate on stamp duty. With this amendment, women home buyers can sell properties to male buyers anytime even after availing the 1% rebate on stamp duty for women in Maharashtra.

3% of property’s market value

Buyers have to pay the stamp duty based on the transaction value as specified in the sale agreement. Note here, that a property cannot be bought or sold below the government-prescribed ready reckoner (RR) rates in Mumbai. This means, the property value must be calculated based on the current RR rates and the stamp duty must be calculated accordingly. In case the house is being registered at a value higher than the RR rate, the buyer will have to pay the stamp duty on the higher amount. If the property is being registered at a value less than the RR rates, the stamp duty will be calculated as per the ready reckoner rates.

Suppose you are buying a property of carpet area of 800 sq ft in an area where the RR rate is Rs 5,000 per sqft. The RR-based value of the property would be 800 x 5000 = Rs 40 lakh.

If the property is being registered at Rs 40 lakh, the buyer will pay 2% of this amount as stamp duty, i.e., Rs 80,000.

If the property is being registered at an amount lower than that, the buyer will still have to pay 2% of Rs 40 lakh as stamp duty, as the property cannot be registered below the RR rate.

If the property is being registered at Rs 50 lakh, the buyer will have to pay 2% of Rs 50 lakh as stamp duty, i.e., Rs 1 lakh.

In Mumbai, several factors can influence the stamp duty and registration charges applicable to a property transaction:

Property type: The stamp duty and registration charges may vary based on the type of property involved. Residential properties, for instance, might attract different stamp duty rates compared to commercial properties.

Property location: The location of the property plays a significant role in determining stamp duty and registration charges. Different regions within Maharashtra may have distinct stamp duty rates and regulations.

Property value: The charges for stamp duty and registration may be calculated based on the property’s value. Typically, the stamp duty on a property sale is a percentage of the property’s selling price.

Ownership type: The type of ownership can also impact the stamp duty and registration charges. For example, properties owned by companies may incur higher stamp duty compared to those owned by individuals.

Home buyers can pay stamp duty and registration charges for property registration online in Mumbai, as the state allows e-payment of stamp duty.

The payment of stamp duty and registration fee can be done through the Maharashtra stamp and registration departments, Government Receipt Accounting System (GRAS).

Users can log on to the website, https://gras.mahakosh.gov.in, provide all the property and personal details and make the online payment using various channels.

Here is a step-by-step process to do that:

Step 1: Select the ‘Pay Without Registration’ option, if you are not a registered user. A registered user can key in the login details to proceed.

Step 2: If you choose the ‘Pay Without Registration’ option, a new page will appear where you have to select ‘Citizen’ and select the type of transaction.

Step 3: Select ‘Make Payment to Register your Document’. You have the option to pay stamp duty and registration charges together or separately.

Step 4: Key in all the required fields to proceed. This would require filling in of the district, the sub-registrar’s office, property details, transaction details, etc.

Step 5: After selecting the payment option, proceed with the payment. After this, an online receipt will be generated. This document must be presented at the sub-registrar’s office at the time of the property registration.

See also: Price trends in Mumbai

To pay Mumbai stamp duty offline, you can follow these methods:

In this payment method, you need to buy stamp papers of the necessary value from a licenced stamp vendor for your transaction. This is applicable when the value of the stamps is below Rs 50,000.

Authorised banks in India offer franking services where they affix a denomination or stamp on property purchase documents. This serves as evidence that the stamp duty for the transaction has been duly paid.

If you have won a Mhada Mumbai house through Mhada lottery, you have to first accept the housing unit and make payment of the property. After this, you need to register the Mumbai Mhada property so that it is present in the Maharashtra state government legal records.

If an applicant wants to cancel the property within six months, he can get a stamp duty refund after a 10% deduction.

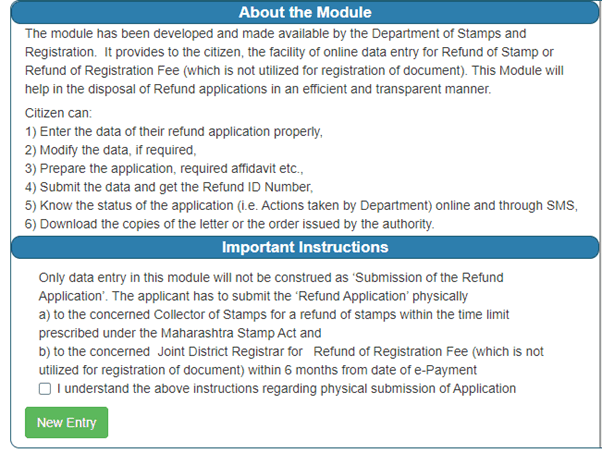

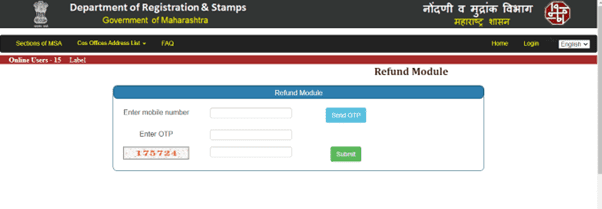

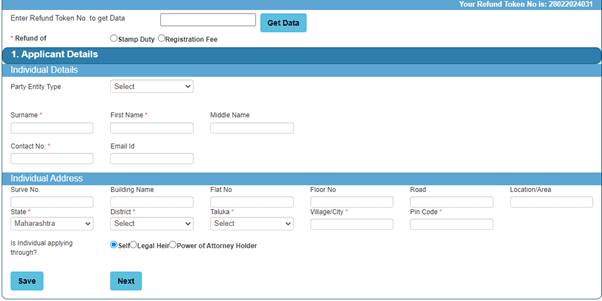

Step 1: Log on to https://appl2igr.maharashtra.gov.in/refund/

Step 2: Agree to the terms and conditions by clicking on check box. Next, click on New Entry.

Step 3: Enter mobile number, OTP, captcha and click on submit.

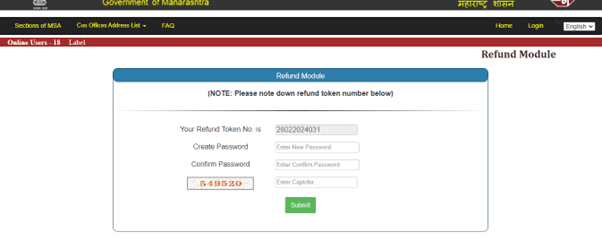

Step 4: You will see refund token number. Create password, confirm password, enter captcha and click on submit.

Step 5: Next click on whether you want to get old data or no.

Step 6: Enter refund token number, select on refund as stamp duty and fill all individual details and address and proceed.

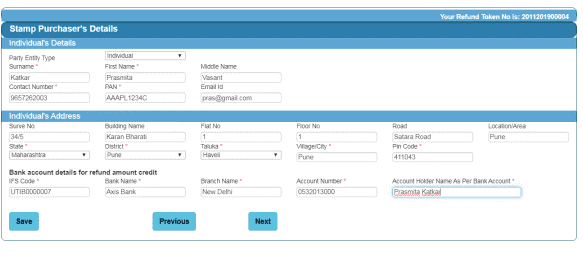

Step 7: Next enter stamp purchaser’s details including bank account details where the amount will be refunded.

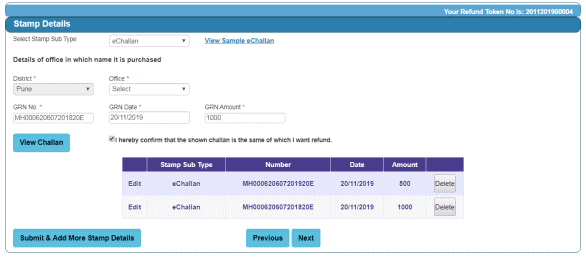

Step 8: This should be followed by stamp details.

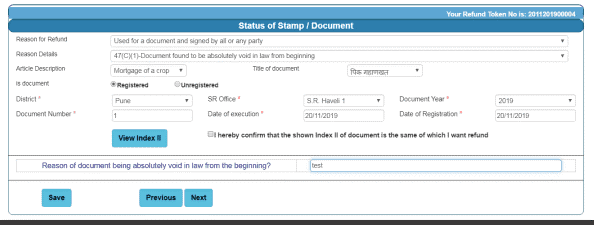

Step 9: Enter the reason for the stamp duty refund and select if the document is registered or not registered.

Step 10: Next upload documents and proceed. Once you follow these steps, you will get an acknowledgment receipt.

Step 1: Log on to https://appl2igr.maharashtra.gov.in/refund/

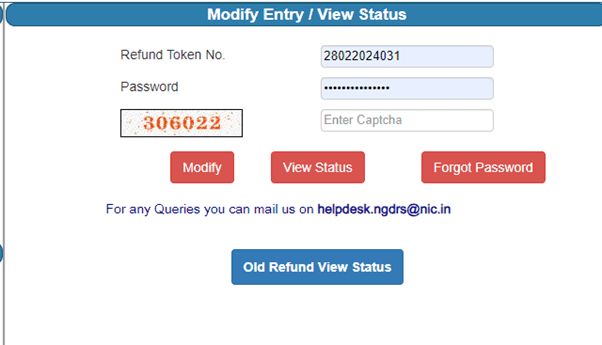

Step 2: Enter the refund token number, the password, the captcha and click on view status. If you want to modify something, click on the modify option.

Step 3: Click on View Status.

Housing.com POV

Maharashtra has been a front-runner state when it comes to stamp duty reforms. Over the past decades, the state government has been launching several schemes from time to time to make property purchases in the state, especially the capital city Mumbai, easier by way of reducing stamp duty rates, correcting registration fee and announcing amnesty schemes. This is one reason why stamp duty earned on property registration in Mumbai is one of the highest seen by any metropolitan city in India. The process of property registration has also been simplified to offer better standards of ease of doing business. However, for the final verification of documents, the buyer and the seller along with two witnesses must witness the sub-registrar’s office on a pre-booked slot. That way, property registration in Mumbai has yet to become entirely online.

The stamp duty rate in Mumbai is 6%.

Stamp duty is calculated, based on the property value as mentioned in the sale agreement. However, note that a property cannot be registered below the RR rates in the city.

Users can visit the Maharashtra government’s Government Receipt Accounting System (GRAS) website, to make the online payment.

The stamp duty on property in Mumbai is payable before execution of the document or on the day of execution of document or on the next working day of executing such a document. Execution of the document means putting signature on the instrument by the person’s party to the document.

The stamp should be purchased in the name of any of the parties who are printing the document. The stamp should not be purchased in the name of the lawyer or the third party.

The buyer is responsible for paying the stamp duty and registration fee on registration of sale deed.

The donor pays the stamp duty on gift deed registration in Mumbai.

It must be the address of the property for which the stamp duty is being paid.

When the Government Receipt No (GRN) and Challan Identification No (CIN) are generated, the transaction is complete from bank. The SROs are provided with Help Line Numbers to take technical support from their IT department, under such circumstances.

With 16+ years of experience in various sectors, of which more than ten years in real estate, Anuradha Ramamirtham excels in tracking property trends and simplifying housing-related topics such as Rera, housing lottery, etc. Her diverse background includes roles at Times Property, Tech Target India, Indiantelevision.com and ITNation. Anuradha holds a PG Diploma degree in Journalism from KC College and has done BSc (IT) from SIES. In her leisure time, she enjoys singing and travelling.

Email: anuradha.ramamirtham@housing.com

These articles, the information therein and their other contents are for information purposes only. All views and/or recommendations are those of the concerned author personally and made purely for information purposes. Nothing contained in the articles should be construed as business, legal, tax, accounting, investment or other advice or as an advertisement or promotion of any project or developer or locality. Housing.com does not offer any such advice. No warranties, guarantees, promises and/or representations of any kind, express or implied, are given as to (a) the nature, standard, quality, reliability, accuracy or otherwise of the information and views provided in (and other contents of) the articles or (b) the suitability, applicability or otherwise of such information, views, or other contents for any person’s circumstances.

Housing.com shall not be liable in any manner (whether in law, contract, tort, by negligence, products liability or otherwise) for any losses, injury or damage (whether direct or indirect, special, incidental or consequential) suffered by such person as a result of anyone applying the information (or any other contents) in these articles or making any investment decision on the basis of such information (or any such contents), or otherwise. The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents.

Stamp duty, registration charges in Mumbai in 2025 – Housing.com News