New data sets, deeper insights, and flexible data visualizations.

Exclusive time with the thought leaders who craft our research.

Boost your brand and generate demand with media programs.

Read through guides, explore resource hubs, and sample our coverage.

Register for an upcoming webinar and track which industry events our analysts attend.

Listen to our podcast, Behind the Numbers for the latest news and insights.

Learn more about our mission and how EMARKETER came to be.

Key decision-makers share why they find EMARKETER so critical.

Take a look into our corporate culture and view our open roles.

Rigorous proprietary data vetting strips biases and produces superior insights.

See our latest press releases, news articles or download our press kit.

Speak to a member of our team to learn more about EMARKETER.

Unraveling Netflix’s growth as a streaming giant and an advertising newcomer

Sign up for the EMARKETER Daily Newsletter

Netflix, a powerhouse in the streaming industry, has revolutionized entertainment consumption since its inception in 1997. From its roots as a DVD rental service to its current dominance as a global streaming giant, Netflix has redefined how audiences engage with streaming content.

In this guide, we dissect Netflix’s business model, drawing essential insights that marketers need to know to develop their connected TV (CTV) strategies.

Founded by Reed Hastings and Marc Randolph as a mail-in DVD rental service, Netflix swiftly adapted to the digital age, launching its streaming service in 2007.

By 2017, Netflix was available in more than 190 countries worldwide, in 21 languages, and reaching 100 million subscribers.

Since then, award-winning original content and forays into in-person events and gaming have helped fuel Netflix’s rise (and price hikes). Netflix has not only disrupted home entertainment, but also continues to shape the evolving streaming and digital video landscape.

Netflix’s strategic approach to subscriptions, advertising, and partnerships remain pivotal in shaping its streaming industry dominance.

At Netflix’s core is a subscription-based model, offering a vast library of video content for a monthly fee. The evolution of Netflix’s subscription structure has been instrumental in its global outreach, adapting to diverse markets by offering tiered pricing options (ranging in the US from its ad-supported plan for $6.99 per month to the standard plan for $15.49 and premium for $22.99) as well as localized content. In summer 2023, Netflix discontinued its Basic tier for new subscribers in Canada, the US, and the UK and expanded that phaseout in 2024.

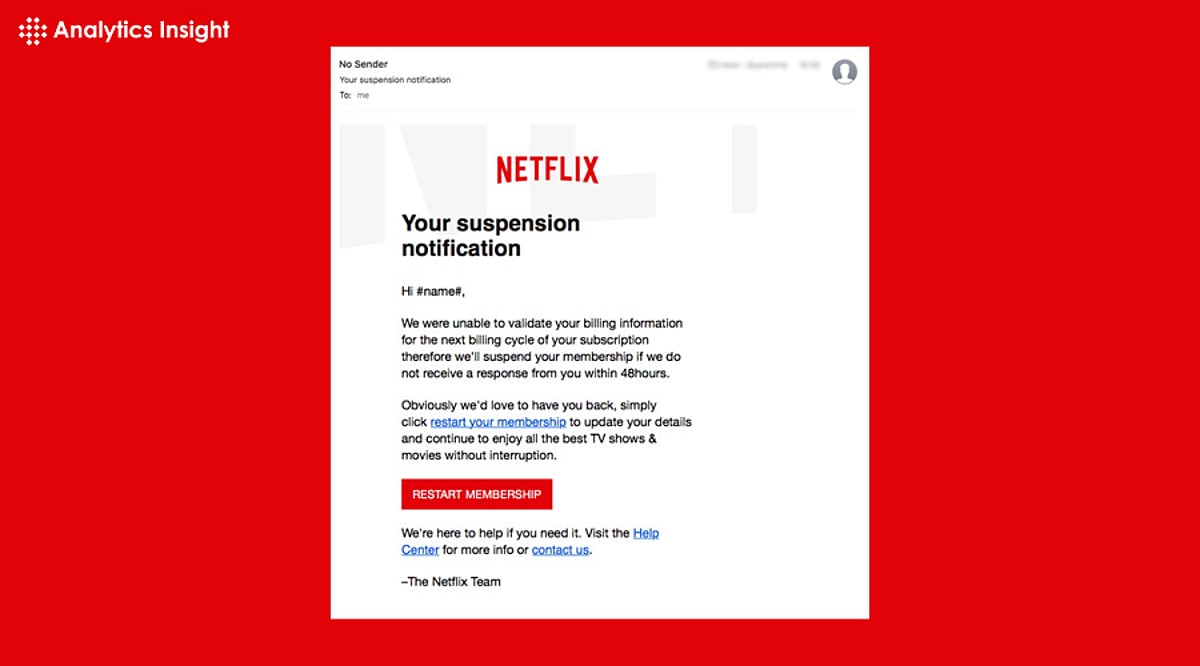

Compared with its streaming competitors, Netflix, which rolled out its ad-supported subscription plan in November 2022, was considered late to the game; yet it only took a year for the ad tier to amass 15 million global monthly active users. This foray into advertising opened up a lucrative revenue stream and a new avenue for advertisers to tap into Netflix’s massive audience.

Since the release, Netflix has bolstered its appeal to advertisers, adding more ad length options, offering “elevated” measurement capabilities, and eventually integrating shoppable functionality such as QR codes to ad creative. These incentives are on top of Netflix’s decision to lower costs per thousand (CPMs) in August 2023. Although it still has the highest CPMs of the major ad-supported video-on-demand subscription services EMARKETER tracks, prices are normalizing, having reached $47.05 in Q4 2023.

Netflix’s strategic alliances and partnerships have played a pivotal role in expanding its content and global reach. Collaborations with acclaimed filmmakers, production houses, and international studios—including Steven Spielberg’s Amblin Partners and Spike Lee’s 40 Acres and a Mule Filmworks—have enriched its library, offering a diverse array of content that resonates with audiences across demographics.

Additionally, co-productions, licensing agreements, and distribution partnerships have also been key to broadening the platform’s content spectrum.

In 2024, there will be 179.4 million US Netflix viewers (or 52.5% of the population), per a February 2024 EMARKETER forecast. Millennials will make up the largest percentage of Netflix viewers, at 52.2 million (or 29.1% of the population).

This year, 13.0 million people in the US will be subscribers to Netflix’s ad-supported plan in 2024.

An outlier among streaming companies, Netflix doesn’t rely very much on ad revenues as of January 2024, signaling a huge opportunity for the platform considering its extensive hold on viewer engagement. Despite generating only 2.5% of US CTV ad revenues in 2023, Netflix captured more than one-fifth of streaming time spent, per EMARKETER’s US CTV Time Spent vs. Ad Spending 2023 report.

Its measured approach is deliberate. “We’re still in the crawl of the crawl, walk, run stage,” Netflix CFO Spencer Neumann said at a conference in September 2023. “We have to scale the reach of our ads tier.”

“I think I’m super bullish and confident in the long-term opportunity of advertising as a big incremental revenue and profit contributor to the business, but we do have to build it over time,” Neumann said.

The “What We Watched: A Netflix Engagement Report,” released twice a year, provides a glimpse into global viewing preferences and highlights the most popular series and film titles, whether they are new, old, licensed, or original.

Its latest version, with data from July 2023 to December 2023, covers more than 18,000 titles and nearly 100 billion hours viewed, and includes metrics per title, such as hours viewed, availability worldwide, and release date.

The viewing data underscores how Netflix’s licensing strategy is crucial to its bottom line, in addition to its ability to draw target audiences because of its position as a powerhouse platform—not solely because of its content offering.

Even though Netflix’s ad-supported subscriber base is relatively modest, its extensive popularity as a streaming platform is enough to bank on the company’s potential as a top contender in ads. In fact, the collective streaming time spent with Hulu, Disney+, ESPN+, and Amazon Prime Video only marginally exceeds Netflix’s time spent by 11%.

As a growing number of consumers look to scale back on discretionary spending amid economic uncertainty, Netflix’s ad tiers are likely to see more uptake.

This article has been updated. Original was posted February 2, 2024.

Want more marketing insights?

Sign up for EMARKETER Daily, our free newsletter.

By clicking “Sign Up”, you agree to receive emails from EMARKETER (e.g. FYIs, partner content, webinars, and other offers) and accept our Terms of Service and Privacy Policy. You can opt-out at any time.

Thank you for signing up for our newsletter!

One Liberty Plaza9th FloorNew York, NY 100061-800-405-0844

1-800-405-0844sales@emarketer.com